“A shift is happening. The early CFO, version 1.0, was The Historian. Next came version 2.0, the Real-Time Analyst who caught issues based on real-time dashboards. It now appears that we are beginning to see a new version: CFO 3.0 – The Futurist.” (Source)

I talk about Excel being my crystal ball all the time. With the right numbers, used in the right way, we can literally see the future. Through financial modeling and forecasting, we can predict what will happen with our revenue, expenses, cash flow, and more. It’s not totally failsafe but it is the most educated guess around.

I love The Futurist CFO 3.0 as described by Intacct, but I think the most successful CFO is a solid combination of all three: Historian, Real-Time Analyst, and Futurist. We can’t know where we’re going until we know where we’ve been. It’s incredibly difficult to make future predictions without any data on past performance.

Intacct says, “the low cost of storage and computing power, coupled with the internet of things revolution, makes available large portions of data for smarter solutions. In short, we can get to answers more quickly by comparing the previously incomparable to discover new trends and relationships that are otherwise beyond our line of sight.”

Yup! And that’s exactly what I do – discover new trends and relationships to help you make better decisions.

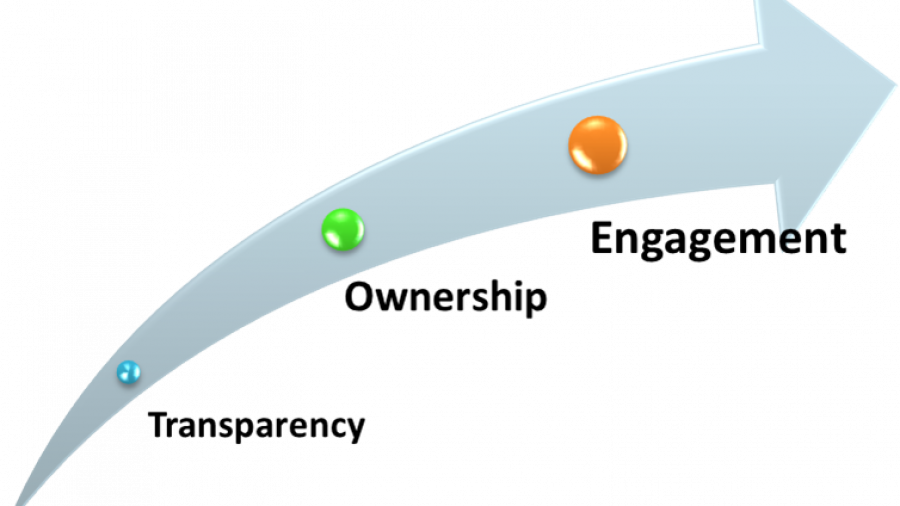

When we decide to work together, I have a tried and true process I use to analyze your numbers and make predictions for the future. Here it is:

- Do a cursory review of chart of accounts. What is missing or redundant?

- Run P&L and balance sheet by month and by year for the past 3-5 years. Review P&L vs budget and variances. Where are the biggest variances? Which revenue streams have grown or decreased the most over time? What are the biggest expense line items?

- Calculate a litany of ratios and financial measures to determine areas for opportunity.

- Review budget and cash flow. Many small businesses don’t have a budget and most organizations don’t have a cash flow, so we create one. This is the crystal ball that gives the most insight to see around corners. Because we’re projecting out 12 months (or more in detailed financial models), we can make educated and accurate predictions based on the historical review in step 2 above so we can change course NOW instead of later to maximize revenue and minimize risk. It sounds easy because it kind of is!

“Such becomes the case for CFO 3.0 – Master Jedi – seeing around corners and flying through walls as they guide their business to scale and profitability.”

Master Jedi, Crystal Ball Reader, Excel Guru, Business Superhero. Or maybe just Chief Financial Officer. 🙂

PS – Do you want to get this deep insight for your organization? I can apply my process above to your numbers to give you info about your business that you haven’t seen before. Grab a spot on my calendar today to start the conversation!