Are you soaking in the summer sun as much as I am? Here at 100 Degrees, I’m splitting my time between supporting clients and taking as many Zoom meetings as possible outdoors. The weather here in Buffalo is only nice for so long, so I’ve got to take advantage of that sunshine!

Lots of our clients have audits going on right now, and all of this audit work can be a major source of stress for nonprofit leaders. There are a lot of questions, a lot of panicked moments looking for that one missing contract, and tons of uncertainty as to whether or not you’ll “pass”.

But I’ve learned a few things after supporting dozens of audits over the years and want to share how to drastically improve efficiencies and reduce time spent on your audit.

If you don’t yet have an audit, STICK WITH ME! These are best practices you can use to free up time and brain space to focus on your mission and ensure you’re ready for any future audit.

Ready? Here are my secrets to a smooth-as-butter audit!

1. An organized, cloud-based document storage system halves prep time. Many audit firms use online file sharing systems, where they have clearly labeled folders for each item requested, so you can just drag and drop files into each one. This has virtually eliminated all back-and-forth email and helped us to speed up the time to prepare and submit documents. And to make your own preparation as quick as possible, start from day one with an online folder system in Google Drive or Dropbox – create a folder for each month and store all timesheets, receipts, bank statements, reconciliations, etc within that folder for easy reference later!

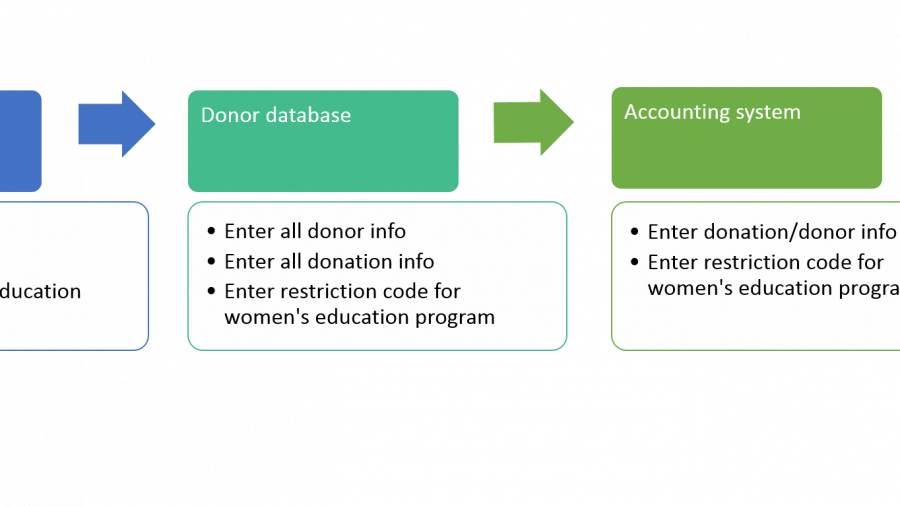

2. Quarterly reviews throughout the year dramatically decrease prep time. If you’ve ever undergone an audit, you probably know the hot topics and past issues for your organization. Common issues I’ve seen are around cash management and grant restrictions, so I suggest you do a mini internal audit of those hot issues each quarter. One client recently did this, completely solved their issues, and wiped the comment from the management letter!

3. The audit is a team effort, not just a task for the finance team. The audit timeline and goals should be shared across the organization because development, leadership, the board, and programs may all get pulled in at some point. Communicate early and often to get the whole team on board.

What questions do you have for me about the audit? Just click Reply and I’d be happy to answer!

PS – Want more info on how to prepare for a stress-free audit? Check out this article >>> https://100degreesconsulting.com/stressfreeaudit/