I just finished reading Thirst, by Scott Harrison, the founder of Charity: Water. It’s a fabulous book that reads like a novel and tells the story of Scott’s personal journey to creating Charity: Water, and all of the bumps and setbacks he encountered along the way. I drew so many parallels to entrepreneurship among other things, but what I want to talk about today is Scott’s and Charity: Water’s unparalleled transparency.

Charity: Water is famous in the nonprofit space for transparently touting the fact that 100% of their donations go to programs (because they have an amazing group of people called The Well who fund operational overhead). Scott also mentions in his book several instances along the way where wells couldn’t be drilled or wells didn’t work or they had disagreements with major donors, and some might chalk these experiences up to major failures to be handled, then swept under the rug.

But not Charity: Water. They operate in a full disclosure manner and are willing to risk their reputation for the sake of transparency.

And guess what? Not only have they not lost credibility but they’ve actually GAINED credibility with their stakeholders and grown to a $50M+ organization.

So putting it all out there does NOT mean that you will lose donors, and in fact, a recent study found a direct correlation between transparency and increased donations.

The full study by Erica E. Harris and Daniel Neely can be summarized into one sentence:

“…transparency in the nonprofit sector is value-added to key stakeholders.”

Aren’t we, as nonprofits, always looking for ways to add more value to our key stakeholders (donors, board, institutional funders, staff, volunteers, etc)?

Transparency is our solution.

Guidestar, one of the charity watchdog organizations, recently published an article about this study and summed it up with two incredibly strong data points:

- donors give more to transparent nonprofits

- transparent organizations tend to be stronger organizations across a range of governance, financial, and operational dimensions

I think we can all agree how vital transparency is to our organizations. Our stakeholders need to know what’s going on behind the curtain, the great, the not-so-great, and the ugly, and when they do, they will feel more connected to our organization, our mission, and donations will increase.

But! How do you become more transparent overnight, you ask?

By sharing the right financial information to the right people at the right times! Here’s everything you need to know to increase your transparency, stakeholder engagement, and donations, using financial information you already have!

Download our Transparency Tip Sheet to help you share your financials the RIGHT way, then keep reading! >>

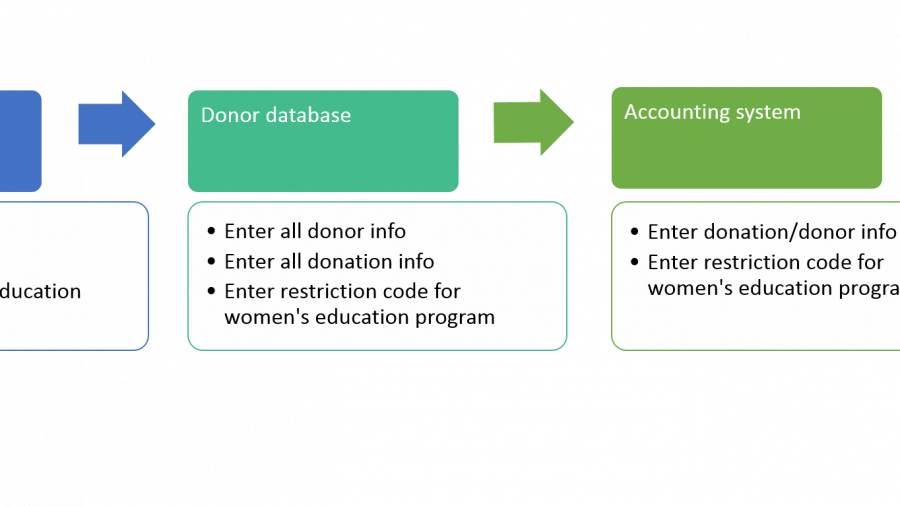

Who to share financial info with? Everyone! Staff, board, donors, volunteers. Financial information about your agency is relevant for all stakeholders. We’ll talk more about what information and how you present it below. What to share? For the sake of understandability, I would recommend sharing different types of information and presentations to different groups of people (using the same set of financials as your base, of course). Board: High-level dashboard – a birds’ eye view – of the quarterly financials and forecasts plus a full balance sheet and income statement for those who want more details Staff: High-level dashboard with highlights that are relevant for them (i.e. share about a new grant or program, or the fundraising results from last month’s gala). The more graphical the presentation, the better!Volunteers/donors/public: High-level and/or public information such as the 990, annual report, and audited financials when to share it?Annually: Annual report, 990, audited financials on website quarterly: Board meetings and staff meetingsMonthly: Board Treasurer and leadership team how do we make the information interesting and readable? PowerPoint. Graphs and charts. Bulleted talking points. Simplicity can be powerful!

Put yourself in your audience’s shoes. Do they know what accrued expenses or current liabilities mean? Probably not. Take five seconds to explain it and you’ll see a lot more head nods than heads buried in smartphones. Again, Excel graphs and charts are your friend. They’re super simple to create and for those of us who don’t get their kicks from black and white spreadsheets full of numbers, they help tell a much richer story of your organization’s financial health.

I encourage you to be transparent about your financials because transparency breeds ownership and ownership breeds engagement and engagement by all stakeholders will take your agency to the next level.

Did you get the Transparency Tip Sheet to implement greater transparency in your organization? Download it here! >>

Want more about TRANSPARENCY? It’s one of my favorite topics and I’ve got you covered here and here.