We all know too well the frustration and despair that comes with trying to lead a team that just doesn’t jive well together. People’s motivation, dedication and skill-sets vary, they’re not on board with your strategic vision for the department, or they just flat-out don’t like each other. As the leader, you may end up doing much of their work yourself, not including them in strategic brainstorming sessions, or stopping team meetings altogether, just to avoid your motley crew of a team.

When I think about a great team, I remember a cold winter evening at a corner booth in an Indian restaurant. The five of us had just finished a big project together and as we sat sipping our cocktails, chatting and laughing, I sat back and thought, I really love this team!

But why?Since then, I’ve tried to figure out how to recreate that team, but since cloning isn’t readily available, I thought of some characteristics and best practices for developing a high-functioning team.

Scrap the resume and look for culture fit. I think I just heard an audible gasp from my HR colleagues, so maybe we don’t want to entirely ignore the resume. But once you’ve determined that they have the basic qualifications, look for culture fit. How will they interact with the other team members, the CEO, or the program staff? Are they passionate about the mission (yes, even the finance team should be passionate about the mission!)? Does their attitude and outlook on life fit in with the organization? I’ve seen time and time again where candidates were hired based on the top school, big name work experience or fancy volunteering on their CV but they flopped within weeks at the new place because they just weren’t a culture fit. Please get to know your candidates and ask them what they’re looking for in their next employer’s culture.

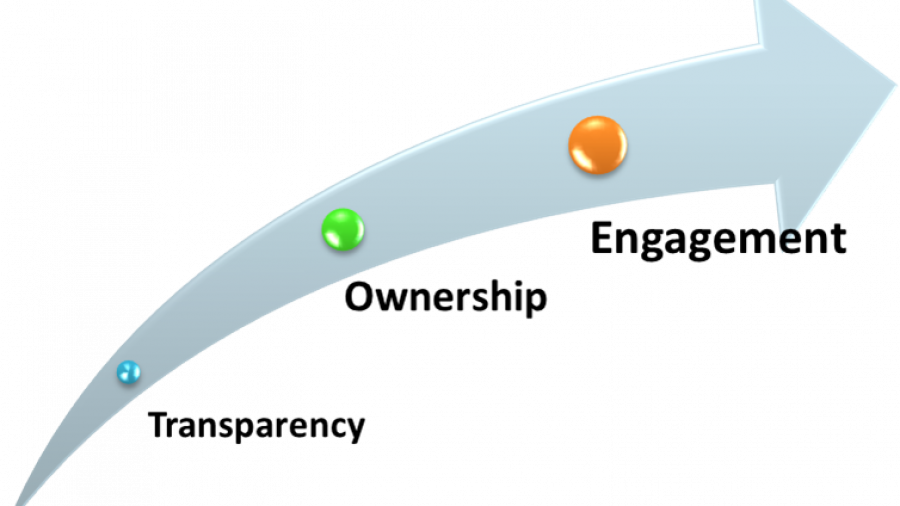

Give them a voice. Most organizations go through an annual strategic planning process with the leadership team and board of directors. CFOs: do you include your staff, even the entry-level accountants? If you want a high-functioning team who’s ready to execute that plan, you must get their input and buy-in from the beginning. I share the prior year’s plan with the group and ask that they come to our next meeting ready to brainstorm and discuss next year. As a finance team, we are so detail-oriented that we don’t often get the opportunity to think big, but in this session we share ideas that contribute to the final draft. Once it’s approved, they already recognize it as part of their work and take ownership over its execution. It is a simple technique that is so often neglected.

Turn them off. No, don’t repulse them by being the smelly lunch eater, but make sure they’re taking vacation or comp time, shutting down computers at a reasonable hour each night, limiting overtime and not checking emails at all hours. Let’s face it – they work at a nonprofit whose cause they’re passionate about so they probably would work 80 hours a week if you asked them. But we should all know by now that productivity will decrease and unhappiness will increase unless our team gets regular breaks from all things nonprofit. As leaders, we need to set the example and the expectations by turning our team (and ourselves!) off at a reasonable time each night. That email will still be there for you in the morning.

Get personal. I love learning people’s stories – their hobbies, families and outside-of-work passions – and in order to build trust I share my story with my team. When I know that Rachel is starting an herb garden or Matt is planning a trip to Sedona or Tom plays in a cover band on the weekends, however irrelevant to our mission as a team, I feel just the tiniest bit more connected to them and our team’s work. We’re not robots, people. Get to know your team.

What was your favorite team like? Were you BFFs or high-efficiency robots or somewhere in between?