We haven’t had coffee together in a while, but if we were catching up today, we’d probably chat about the weather (80 degrees in October?!) and maybe our families and probably your latest win at work!

As for me, currently I am…

Celebrating one year of 100 Degrees Consulting! In the past year, we’ve led 3 workshops, worked with 5 clients on countless projects, survived 2 annual audits with clients, written 12 blog posts, and analyzed countless financial statements. Year two can only hold more excitement for my clients! Maybe you’ll be one of them?

Planning for year-end close with two of my clients. I know it’s only November but it’s never too soon to start thinking about how we’re going to make sure the year is closed accurately and timely. To help you all out, I’m developing a monthly/annual close checklist that will help guide you through your monthly close too. So many potential clients I speak with don’t have any type of close process which means they don’t have as much visibility into their numbers as they could.

Reading more blogs than anything else these days. Some of my favorites are Melyssa Griffin, Tara Gentile, and Lead Change Group. Does anyone have any great blogs I can add to my list?

Listening to the Hamilton soundtrack. We were gifted tickets to the Chicago show and while I was initially skeptical at how it could possibly live up to the hype, I really enjoyed the show and found myself singing the songs for days after. I bit the bullet and bought the soundtrack!

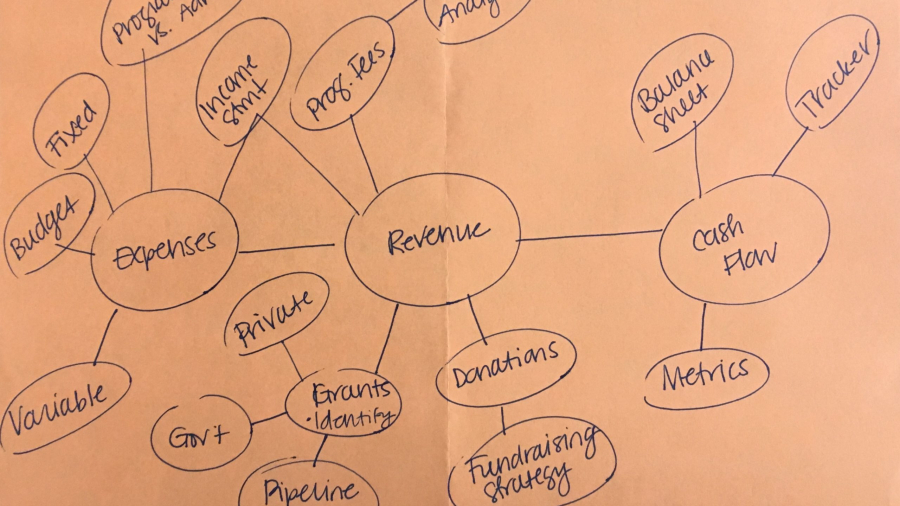

Working on a financial management program for entrepreneurs. Think a workshop series where I would provide you the tools you need to get a handle on your finances, make sure you’re charging enough, identify your margins, and provide hands-on coaching throughout the whole process. You’ll walk away with confidence in your numbers and insight to make strategic business decisions to help you grow!

Thinking about our next travel adventure! We just got back from a quick trip to Dublin, Ireland, thanks to some Delta vouchers and that sparked the wanderlust again! I’m thinking Scotland, summer 2017. Who’s been?

Enjoy your Tuesday morning coffee, my friends!